2

Issue 26 - DECEMBER 2020

www.bahrainbourse.comBAHRAIN BOURSE AND ISRAEL DIAMOND EXCHANGE SIGN

AN MOU

BAHRAIN BOURSE ELECTED BY THE CONSENSUS AS MEMBERS

OF THE ARAB FEDERATION OF EXCHANGES BOARD OF

DIRECTORS

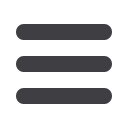

Bahrain Bourse announced signing

a Memorandum of Understanding

(MoU) with Israel Diamond

Exchange (IDE) on Thursday,

3

rd

Dec. 2020 to explore areas

of mutual interest and joint

cooperation between the two

exchanges, and to develop channels

of communication and foster the

relationship between Bahrain

Bourse and Israel Diamond

Exchange. The MoU was

signed by Shaikh Khalifa bin

E b r a h i m A l K h a l i f a ,

Chief Executive Officer of

Bahrain Bourse and Mr. Yoram

Dvash, President of Israel

Diamond Exchange (IDE).

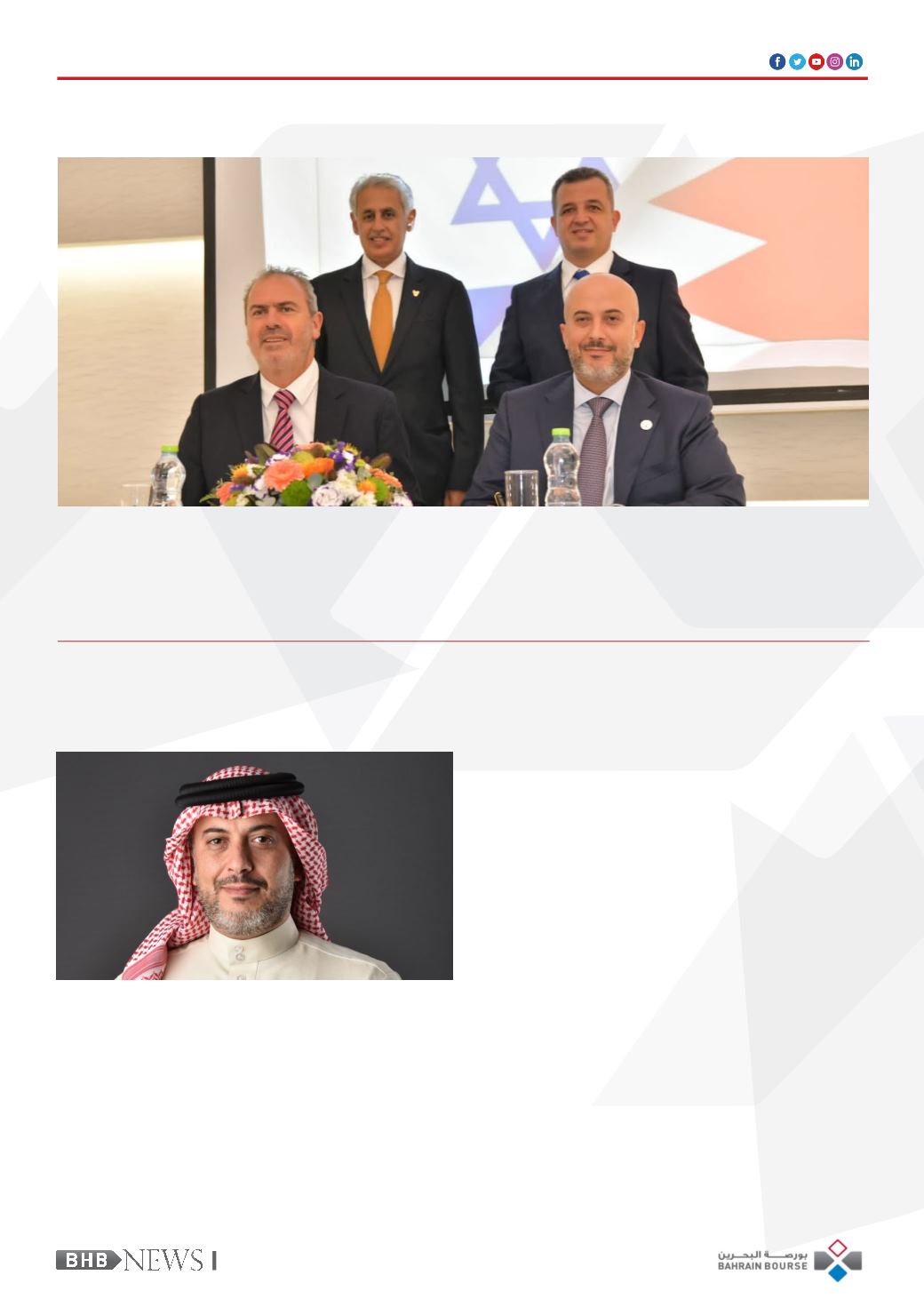

Bahrain Bourse participated in the

meeting of the General Assembly of

the Arab Federation of Exchanges

(AFE), which was held virtually

with the participation of the Chief

Executive Officer of Bahrain

Bourse, Sh. Khalifa bin Ebrahim

Al-Khalifa and Chief Operating

Officer of Bahrain Bourse, Narjes

Farookh Jamal along with various

CEOs of stock exchanges and Arab

clearing and depository companies.

During the meeting, Bahrain

Bourse was elected by the

consensus of the members, in

addition to the Saudi Stock

Exchange (Tadawul) as members of

the Federation’s Board of Directors,

representing the Arab Gulf Region.

Amman Stock Exchange and

Beirut Stock Exchange were elected

to represent the Levant region,

and the Egyptian Exchange and

the Casablanca Stock Exchange

to represent the Arab African

countries. Misr for Central

Clearing, Depositor y and

Registry and Kuwait Clearing

Company were elected to represent

Arab clearing houses. In addition,

Damascus Securities Exchange,

Muscat Clearing and Depository,

and the Khartoum Stock Exchange

were elected as members of the

Audit and Governance Committee.

It is worth mentioning that the

AFE was established in June 1978

to be the guiding body for the

Arab stock exchanges, under the

recommendation of the Arab

Central Banks Conference, held

under the auspices of the General

Secretariat of the League of Arab

States in the Hashemite Kingdom

of Jordan. The Federation aims to

create a transparent environment

for the Arab capital markets,

develop market members and

reduce the barriers of security

trading across the countries

through establishing harmony

across the laws and regulations of

the Arab countries, adopting new

technologies and advanced trading

and clearing settlements. The

federation currently has 21 members

representing around 17 stock

exchanges and 4 clearing

c omp a n i e s , i n a d d i t i o n

to a number of brokerage

companies in the Arab region.