5

Issue 20 - JUNE 2019

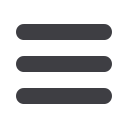

www.bahrainbourse.comBAHRAIN BOURSE & MEIRA ESTABLISH A BAHRAIN CHAPTER TO FURTHER

ADVANCE INVESTOR RELATIONS LANDSCAPE IN THE KINGDOM OF BAHRAIN

CERTIFIED INVESTOR RELATIONS PROGRAM ROLLED-OUT UNDER THE

INVESTMENT ACADEMY UMBRELLA

Bahrain Bourse and the Middle

East Investor Relations Association

(MEIRA) has officially launched

a new chapter in Bahrain, to

further develop and enhance best

practices in Investor Relations (IR)

across the Kingdom of Bahrain.

The MEIRA Bahrain Chapter

was formal ly inaugurated

yesterday at the signing ceremony

of founding members who have

recognised their commitment

to develop the IR function in

the local market. The founding

Middle East Investor Relations

Association (“MEIRA”) and the

Bahrain Institute of Banking &

Finance (“BIBF”) in the presence

of MEIRA Bahrain Chapter Head,

signed an agreement to roll-out

the Certified Investors Relations

Program (‘CIRO’) in the Kingdom

of Bahrain under the Investment

Academy umbrella. The CIRO

members include Aluminium

Bahrain (‘ALBA’) (represented

by Eline Hilal), Bank ABC (rep-

resented by Brendon Hopkins),

Bahrain Telecommunications

C o m p a n y

( ‘ B a t e l c o ’ )

(represented by Faisal Qamhiyah),

Ithmaar Holding (represented by

Sameh Mohamed Mahmandar),

National Bank of Bahrain

(represented by Russell Bennett),

and SICO BSC (c) (represented

by Fadhel Makhlooq). Bahrain

Bourse will also lead the Chapter

represented by MEIRA Bahrain

Chapter Head, Marwa AlMaskati.

The signing ceremony took place

at Bahrain Bourse premises and

it was followed by an IR seminar

attended by more than 30

representatives from local listed

companies who had the opportunity

to discuss the importance of the

IR function from the investment

community perspective. This

initiative is part of the MOU

signed between MEIRA and

Bahrain Bourse in order support for

the development of international

standards in IR and corporate

governance across the Kingdom.

Members of the MEIRA Bahrain

Chapter will now have access to

a wealth of IR knowledge from

global leaders in the profession in

the form of specific educational

initiatives and will be able to

benefit from engaging local

events aimed at uniting and

advancing the IR community.

program has been launched

as a joint initiative between

B a h r a i n B o u r s e ( BHB ) ,

ME I RA , a n d t h e B I BF.

The signing ceremony took place

at Bahrain Bourse premises and

it was followed by a seminar

attended by representatives

from local listed companies

who had the opportunity to

d i s c u s s t h e i mp o r t a n c e

of the CIRO certification

within their line of work.

The CIRO program aims to

offer professional talent a unique

o p p o r t u n i t y t o a c q u i r e

certification within IR, which is

increasingly becoming an important

function within listed companies.

The CIRO program will be

fully supported by Tamkeen

(Labour Fund) under their

Training &Wage Support program.

The CIRO program is an interna-

tionally recognised certification

program for the investor relations

profession. In the Middle East, the

program is organised by the Middle

East Investor Relations Association

(MEIRA), in partnership with

the UK IR Society (UKIRS) and

delivered by the Bahrain Institute

of Banking and Finance (BIBF)

in the Kingdom of Bahrain. A

three-day intensive training

course of a total of 20 hours, is

followed by a 60-minute exam.

The Certificate in Investor

Relations is regarded as a valuable

benchmark for IR professions.

Obtaining the Certificate in

IR would enable delegates to

obtain international recognition as

a qualified IR practitioner, demon-

strates expertise and competence

in IR field, and enhances

career development within IR.

The program focuses on six key

topics: principles & practices

of investor relations, global

financial markets, companies &

regulation,regulatory environment,

accounting, valuation & investment

principles, effective IR in practice.