3

Issue 23 - MARCH 2020

www.bahrainbourse.comBAHRAIN BOURSE ADOPTS ITS NEW LISTING RULES

As part of Bahrain Bourse’s

(“BHB”) continuous efforts to

develop the Capital Market in

the Kingdom of Bahrain, and in

pursuance of Central Bank of

Bahrain Resolution No. (11) of

2018 for the implementation of

the Self-Regulatory Organization

(SRO) , Bahrain Bourse published

the new Listing Rules on 13

th

January 2020. The new listing

rules aim to clarify the regulatory

and organizational framework

governing all operational aspects

of Bahrain Bourse, particularly

future listings. The new Listing

Rules will be effective immediately,

allowing for companies currently

listed on the market a grace

period of 3 months to abide by

the requirements of the new rules.

The new listing rules apply to all

listed securities which are currently

listed on the market as well as

those interested to list on Bahrain

Bourse. The new listing rules aim

to regulate the offering of securities

in the Kingdom of Bahrain, which

includes the conditions of the

offer of securities and identifies the

requirements of listing and offering,

as well as the conditions and

requirements of capital changes.

In addition, the rules regulate the

continuing obligations on issuers

whom their securities are listed

in the Main Market as well as

the suspension of trading listed

securities and delisting of listed

securities. Further, the Listing

Rules also govern the listing of

Exchange Traded Funds as well as

Real Estate Investment Funds. In

accordance with the Listing Rules,

BHB shall become the “main point

of contact” for all Applicants and

Issuers for matters pertaining the

listing application and ongoing

obligations, in which issuers of

securities and financial instruments

interested to list on Bahrain

Bourse are required to submit their

listing application and supporting

documents to Bahrain Bourse

directly. The Bourse will then

discuss the outcomes of the

application review with the

Central Bank of Bahrain’s Capital

Markets Supervision Directorate,

in a period not exceeding 28 days

from the application submission

date. The Listing Rules also specify

the ongoing obligations that

Issuers have to comply with

following listing on Bahrain Bourse

including maintaining a Free Float

of at least 10% of the total issued

outstanding shares. In addition,

an Issuer must sign the deposit

of securities agreement with

Bahrain Clear, in accordance

to article (94) of the CBB Law

prior to the listing of its Securities.

In addition, BHB may discretionally

impose administrative fines on

Issuers for any non-compliance

with Listing Rules and any other

applicable BHB rules, regulations

and Directives. The rules also state

that all Issuers must have effective

systems and internal complaint

p r o c e du r e s f o r h and l i ng

o f c omp l a i n t s ma d e by

their investors, as per CBB

Rulebook Volume 6 - Dispute

Resolution, Arbitration and

D i s c i p l i n a r y P r o c e e d i ng s

Module. The Bourse Investigation

Committee (BIC) shall receive

complaints which constitute

a violation to BHB’s law.

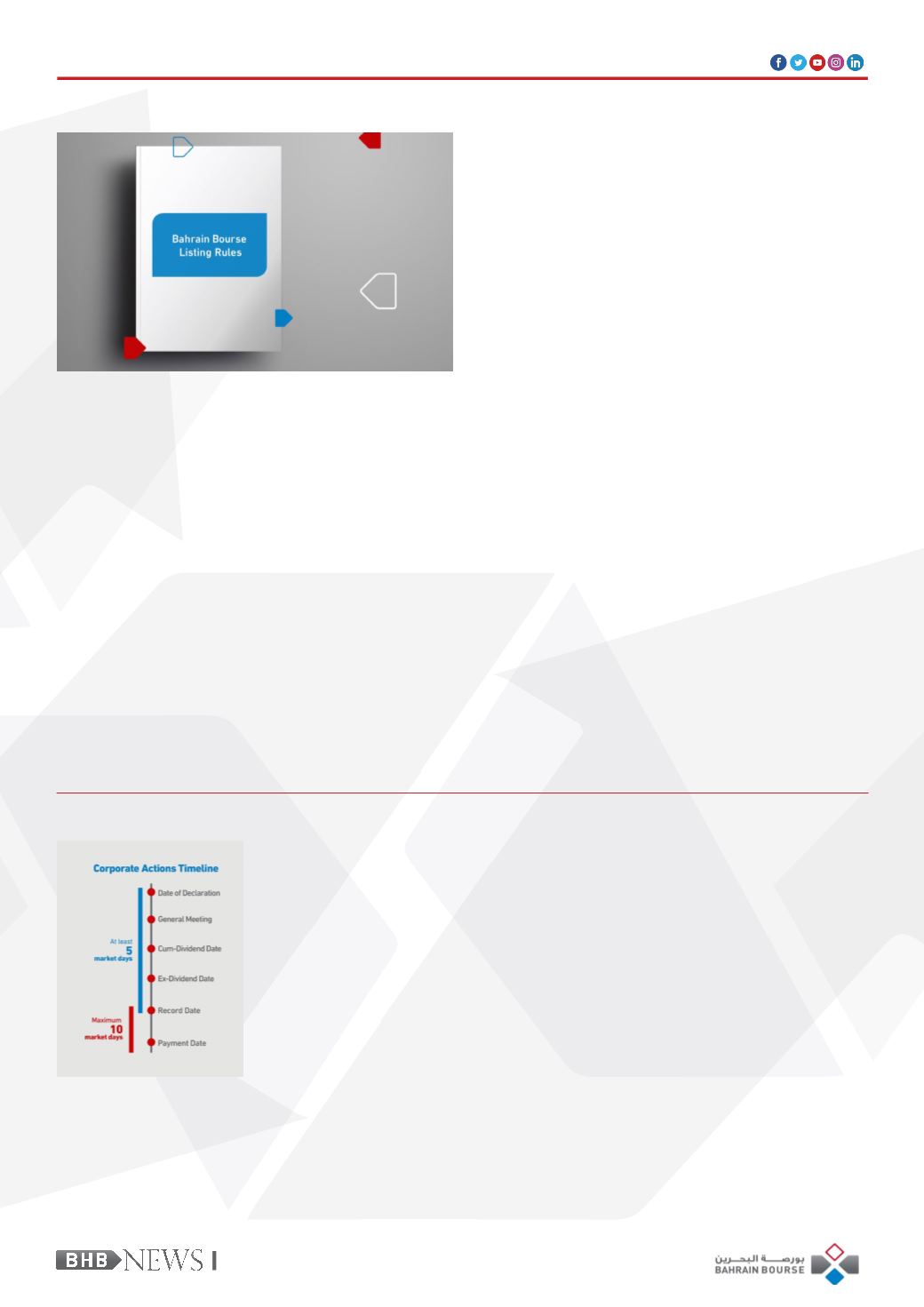

BAHRAIN BOURSE ENHANCES CORPORATE ACTION TIMELINE

As part of Bahrain Bourse’s

(“BHB”) continuous efforts to

develop the Capital Market in

the Kingdom of Bahrain, and

in relation to the Listing Rules

published on 13

th

January 2020 and

recent amendments to requirements

under CBB Disclosure Standards,

Bahrain Bourse would like to no-

tify shareholders of all listed com-

panies of amendments put in place

for providing specific timeframes

in relation to recommendation

of declaration of dividends. The

corporate action timelines

amendments aim to provide further

flexibility for shareholders to

conduct their trading transactions

post the recommendation of

declaration of dividends announced

during the General Meeting date.

The Listing Rules published on 13

th

January 2020 along with Central

Bank of Bahrain’s amendments

in relation to Corporate Actions

timeline (has been implemented

with an objective to enhance the

existing practice and eliminate any

potential redundancy and ambi-

guity with respect to the timeline

mechanism of declaration

and payment of dividends and

Bonus shares if any. Further, the

amendments have been put in

place in line with international

best practices and to achieve

c on s en s u s a c ro s s ma r ke t

participants. The amendments

of corporate action timelines

a n d m e c h a n i s m p r o -

vides specific timeframes in

relation to recommendation

of declaration of a dividend

(including bonus shares, if any),

the rate and amount per share,

the Record Date, the Cum-

Dividend Date, the Ex-Dividend

Date and the Payment Date.

The amended corporate action

timelines, which came into effect

as of December 2019, requires that

the Cum-Dividend Date falls at

least one trading day (excluding the

date of the general meeting) after

the date of the general meeting.

Issuers must ensure payment of

declared dividends to shareholders,

whose names are registered in

the company’s share register on

the Record Date, no later than 10

trading days from the Record Date.