3

Issue 19 -MARCH 2019

www.bahrainbourse.comBAHRAIN BOURSE AND TAMKEEN SIGN AN MOU TO SUPPORT GROWTH BUSINESSES

TO LIST ON BAHRAIN INVESTMENT MARKET

CBB ISSUES RESOLUTION NO. (23) OF 2019 FOR THE ISSUANCE OF REGULATIONS IN

RESPECT OF SHORT SELLING AND GIVING SECURITIES ON LOAN

Bahrain Bourse and Tamkeen

signed an MOU on 7

th

March 2019

to expand the scope of Tamkeen’s

Business Development Program

to include support of growth

businesses interested in listing on

the Bahrain Investment Market

(BIM), an innovative equity market

designed specifically to offer the

region’s fast-growing companies

As part of the Central Bank of

Bahrain’s (“CBB”) effort to develop

the financial sector in the

Kingdomof Bahrain and in line with

international best practices,

the CBB has issued Resolution

No. (23) of 2019 for the

Issuance of Regulations in

an alternative cost-and-time

effective means for raising capital.

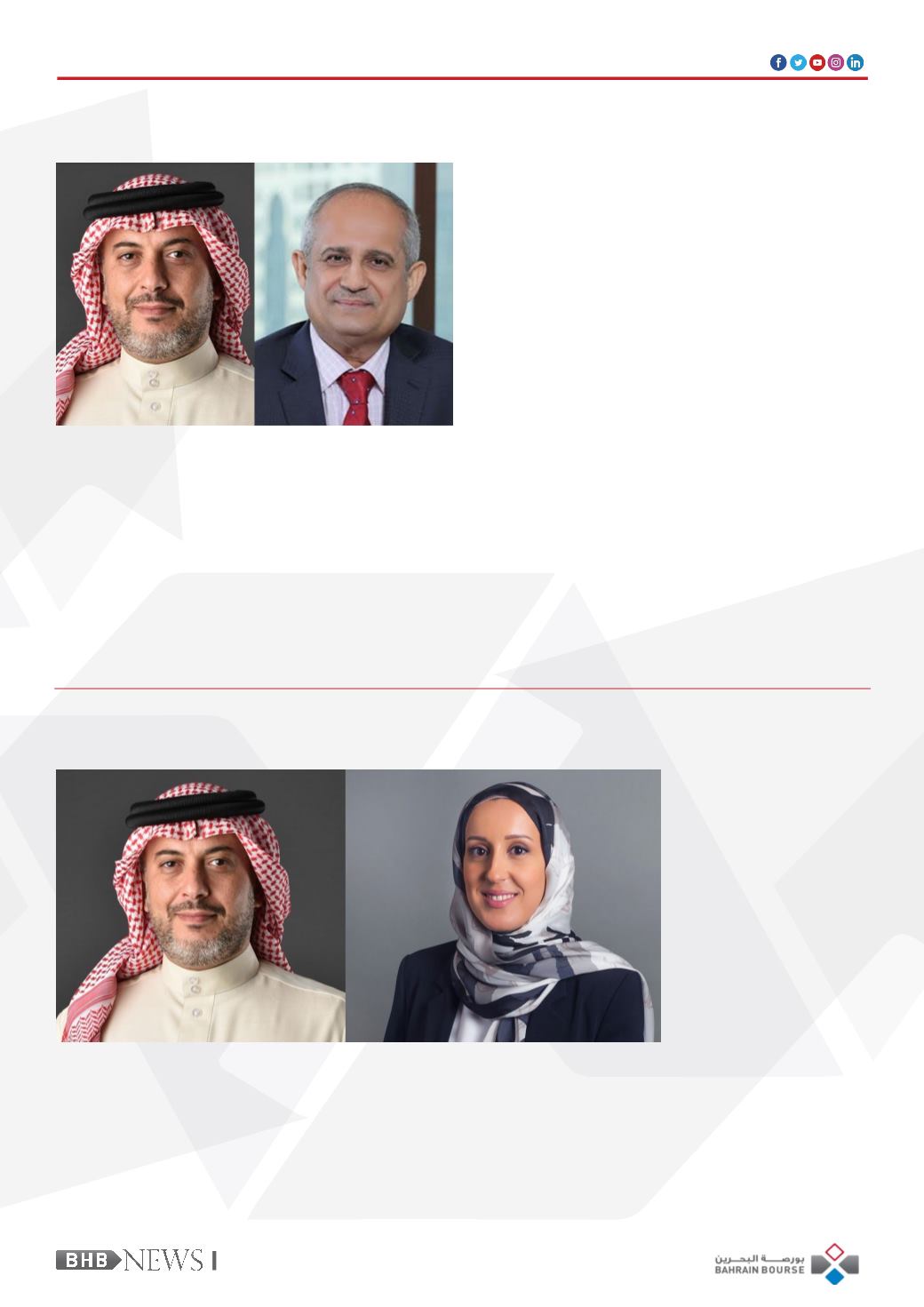

The MOU was signed by the

CEO of Bahrain Bourse Shaikh

Khalifa bin Ebrahim Al Khalifa

and the Chief Executive of

Tamkeen, Dr EbrahimMohammed

Janahi in the presence of several

officials from both organisations.

According to the MoU, the

support extended to growth

companies will cover 50% of

the costs associated with listing

on Bahrain Investment Market

and appointing an Auhtorized

Sponsor (specialized advisory

firm) at a cap of BD30,000 per

company. In addition, the support

wi l l cover 10 companies

ov e r a one - y e ar p e r i od .

The BIM is an innovative equity

market launched by Bahrain

Bourse to enable fast-growing

companies in the Kingdom of

Bahrain, the GCC and MENA

region to obtain growth capital via

direct offering. The market offers a

more relaxed regulatory framework

with easier disclosure and

minimal admission requirements,

as well as support and guidance

provided through specialized

advisor y firms (Sponsors).

According to Bahrain Bourse’s

regulations, companies interested

in listing on Bahrain Investment

Market are required to appoint

and retain the services of an

Authorized Sponsor at all times

(prior and during the listing

process). The Authorized Sponsor

will be responsible for providing

companies with the required

support and guidance to fulfill

the admission for listing on

criteria Bahrain Investment

Market, and ongoing financial

disclosure requirements once listed.

Currently, the BIM’s network

of authorized consulting firms

includes Grant Thornton, KPMG,

Key Point, BDO Consulting,

SICO, and Almoayyad Chambers.

respect of Short Selling and

Giving Securities on Loan,

published in t he Officia l

Ga z e t t e No. ( 3 4 1 1 ) , on

Thursday 21

st

March 2019.

By virtue of Article (92) of the

Decree No. (64) of 2006 with

respect to promulgating the

Central Bank of Bahrain and

Financial Institutions Law (“CBB

Law”) which states that, “The

Central Bank shall specify the

types of securities, which may

be traded by loan and short sale,

the terms and procedures of

such transactions and the rights

and obligations of all concerned

parties”, this Resolution introduces

shor t s el l i ng and g iv i ng

s e c u r i t i e s

o n

l o a n

i n t o t h e K i n g d o m ’ s

capital markets ecosystem.

In order to ensure the effective

implementation of the provisions

of this Resolution, the CBB

emphasized that the Licensed

Exchange and the Licensed

Clearing House shall issue their

own rules and guidelines and

shall establish controls and

procedures related to dealing

in securities through lending

and borrowing and short

selling according to the provisions

stipulated in the Resolution.