4

Issue 13 - SEPTEMBER 2017

www.bahrainbourse.comAccording to the agreement, the

shares of United Gulf Holding

Company will be traded as of

Thursday, 28th of September 2017

under the trading symbol (UGH)

in the regular market under the In-

vestment Sector, according to the

procedures followed in the market.

According to the second agree-

ment, Bahrain Clear will provide

United Gulf Holding Company

with a variety of services that in-

cludes maintaining a record of the

share register that holds the shares

in electronic form, and updating

the data of the registry resulted

from dealing on the company’s

shares in accordance with the rules

and regulations of Bahrain Bourse.

In addition, Bahrain Clear will

provide United Gulf Holding

Company with online services

that include real-time shareholding

confirmations with the percentage

of investors’ holdings’ dealings,

investors’ account statements,

and other periodical reports.

UGH is a Bahraini Sharehold-

ing Company (Public), recently

incorporated in the Kingdom of

Bahrain to own the entire share

capital of the Bank which will

continue to operate under its ex-

isting banking license and, on the

other hand, the investment assets

(and certain liabilities) will be

transferred from the UGB to UGH.

UGH has acquired 100% share cap-

ital of UGB (net of treasury shares),

in consideration for newly issued

shares of UGH at an exchange ra-

tio of one newly issued UGH share

for every two UGB shares, post

fulfillment of regulatory approvals

from the Central Bank of Bahrain.

BAHRAIN BOURSE LISTS UNITED GULF HOLDING COMPANY POST

100% ACQUISITION OF THE LISTED SHARES OF UNITED GULF BANK

AND ASSIGNS BAHRAIN CLEAR AS A SHARE REGISTRAR (CONTINUED)

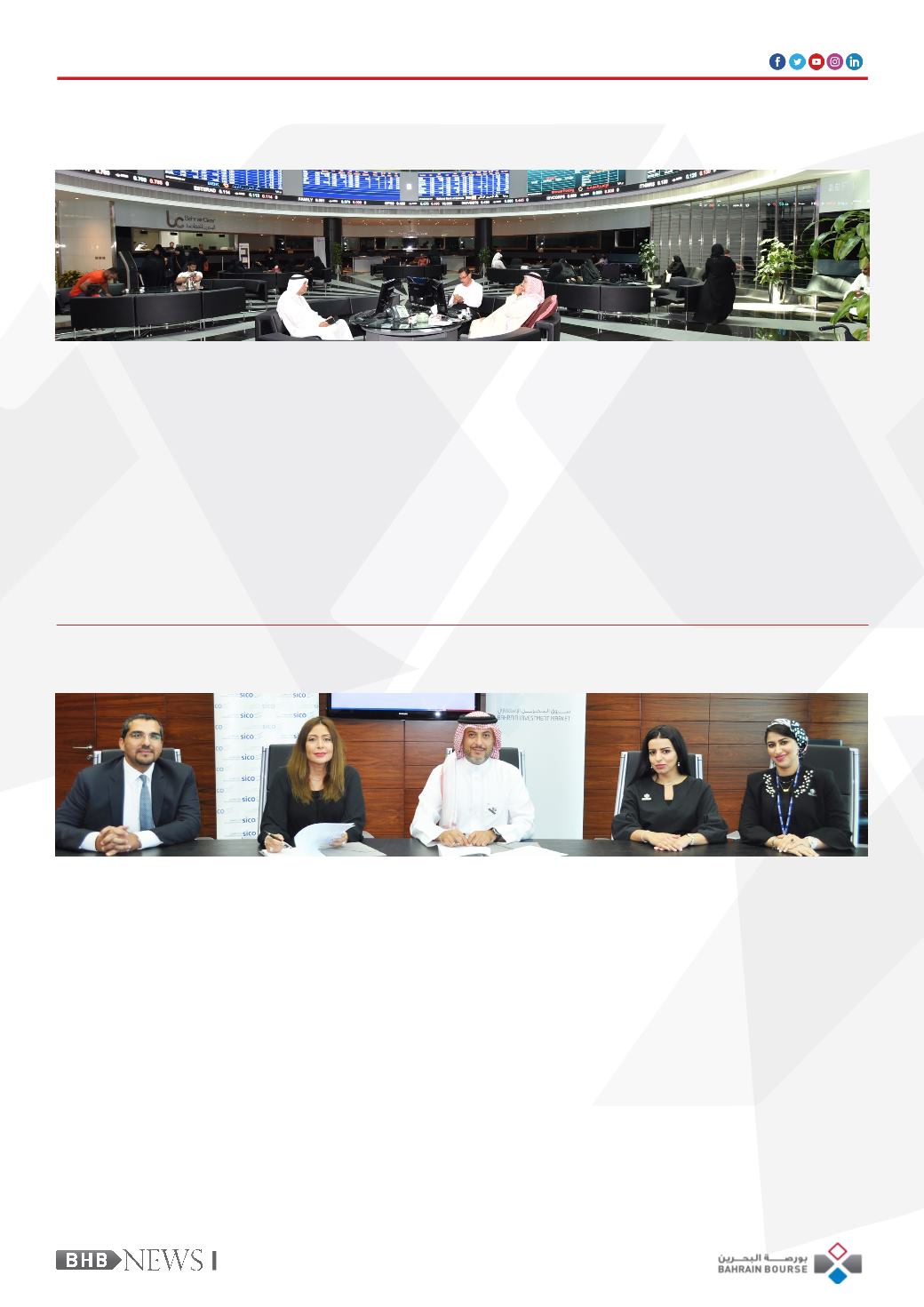

Bahrain Bourse (BHB) and Se-

curities & Investment Company

(SICO) signed on Monday 21

st

August 2017 an agreement to

appoint SICO as an Authorized

Sponsor in Bahrain Investment

Market (BIM), an innovative

equity market for growth com-

panies in Bahrain and the wider

MENA region. The agreement was

signed by the Chief Executive Of-

ficer of Bahrain Bourse, Shaikh

Khalifa bin Ebrahim Al Khalifa

and the Chief Executive Officer

of SICO, Mrs. Najla Al-Shirawi.

The agreement with SICO has

added one more key partner to

SICO APPOINTED AS AUTHORIZED SPONSOR ON BAHRAIN

INVESTMENT MARKET

the cornerstone of support that

BIM offers businesses and enter-

prise investors looking to estab-

lish and grow their presence in

the region. In addition to access

to capital, listed companies will

benefit from specialized advisory

services in multiple sectors and

the implementation of globally

accepted standards for financial au-

diting and reporting statements as

mandated by the BIM. Authorized

Sponsors play an integral advisory

role to all new clients in ensuring

all pre-listing requirements and

post-listing documentation and

disclosures are continuously met.

Headquartered in the Kingdom of

Bahrain, and with a growing re-

gional presence and international

footprint, SICO is one of the pre-

mier wholesale banks in the GCC

region. SICO provides a select

range of investment banking solu-

tions – brokerage, market making,

treasury, asset management, cor-

porate finance, and custody and

fund administration – which are

underpinned by an independent,

value-added research capability.

SICO has a long and successful

track record in organizing, man-

aging and arranging primary

and secondary offerings on BHB.

Bahrain Investment Market’s part-

nership with SICO follows similar

tie-ups earlier this year with well-

known specialized advisory firms,

KPMG, Keypoint, & BDO Jawad

Habib. The increasing network of

authorized sponsors that BIM is

partnering with have significant-

ly enhanced the options available

for prospective companies inter-

ested in listing on Bahrain Invest-

ment Market. For the authorized

sponsors (specialized advisory

firms), the benefits include be-

ing associated and authorized

by a licensed exchange, as well

as access to dynamic companies.