4

Issue 18 - DECEMBER 2018

www.bahrainbourse.comAPM TERMINALS BAHRAIN ANNOUNCES THE PROVISIONAL RESULTS AND ALLOTMENT

BASIS OF ITS INITIAL PUBLIC OFFERING (IPO) WITH AN OVERSUBSCRIPTION

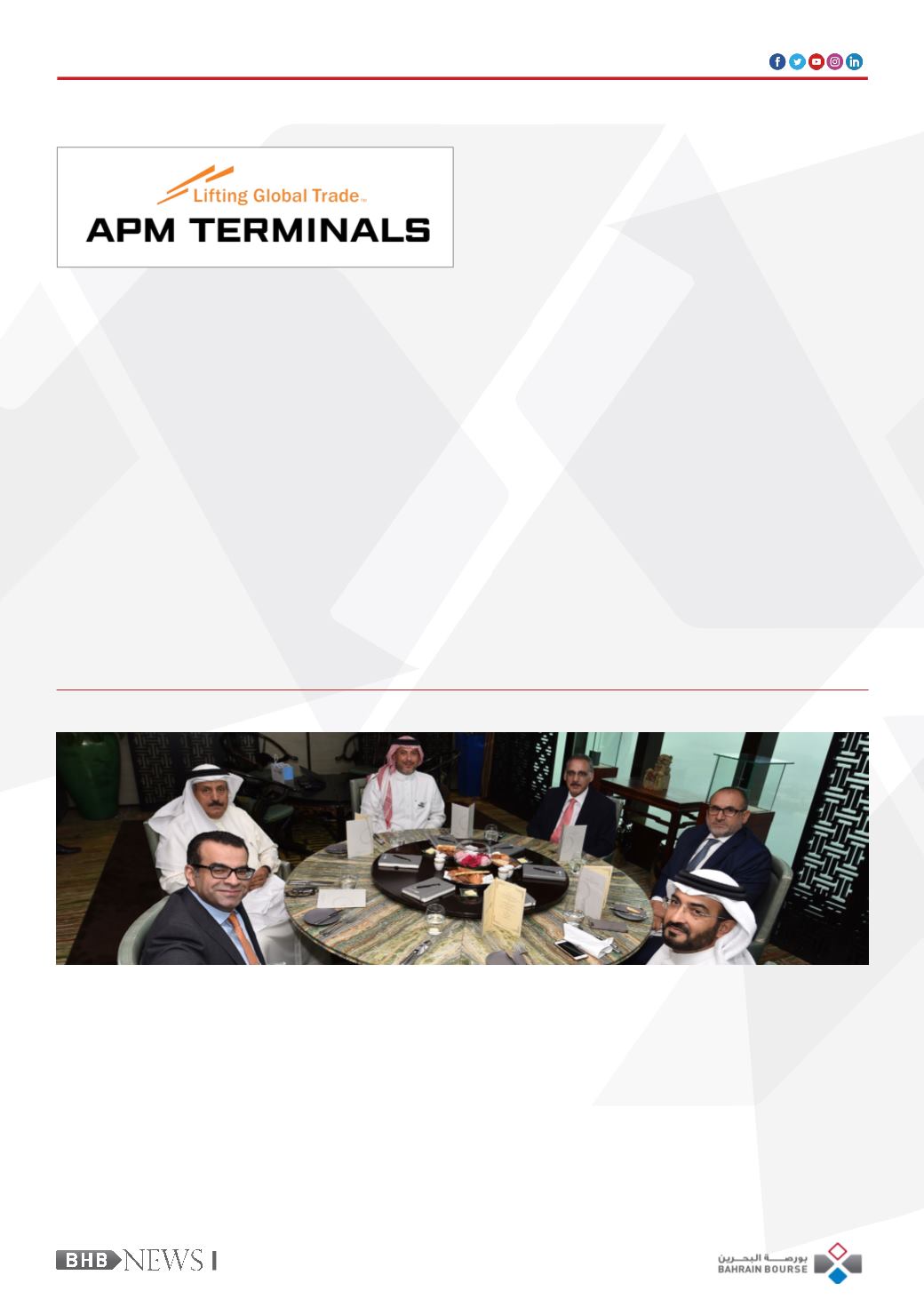

Bahrain Bourse announced

conducting its first round

table discussion for this year with

the listed companies on Bahrain

Bourse on Monday 22 October

2018, with the attendance of

Mr. Abdulkareem Bucheery the

Chairman of Bahrain Bourse,

Shaikh Khalifa Bin Ebrahim Al

Khalifa the Chief Executive Officer

of the Bahrain Bourse and various

CEOs of listed companies. The

APM Terminals Bahrain’s BHD

11.880 million IPO was met with

strong demand from local and

regional institutions and retail

investors alike, resulting in an

oversubscribed offer with funded

applications totaling 6.8 X the

institutional offer size and 2.2 X

the retail offer size. An overall

oversubscription resulted from

funded applications 5.4 X the

offer size. These results reflect

the provisional reconciliation

of the data related to the

application forms received.

SICO BSC (c), a leading regional

asset manager, broker and

investment bank (licensed as a

BAHRAIN BOURSE MEETS CEOs OF LISTED COMPANIES

discussion addressed various topics

in relation to the development

of the capital market in general

and Bahrain Bourse in particular.

The discussion aims at offering a

platform of open discussion and

encourages exchange of ideas,

recommendations and opinions

on enhancing the capital market

in the Kingdom of Bahrain.

Furthermore, the discussion

aims at finding mechanisms

to enhanc e t he Bou r s e’s

performance in a way that serves

and benefits listed companies

on one hand, and contributes to

enriching investors’ experience on

the other hand. The discussion

also presented the opportunities

and challenges occurring in light

of the current economic changes

locally, regionally and globally.

The series of meetings will allow

the listed companies to address

various topics of interest, highlight

their view on enhancing the

market’s performance and other

relevant matters, as this meeting

comes in line with Bahrain

Bourse’s keenness to diversify the

c ommu n i c a t i on c h a nn e l s

wit h a l l rele v ant par t ies

especially listed companies.

conventional wholesale bank

by the Central Bank of Bahrain

(“CBB”), announced the successful

closing of the BHD 11.880

million initial public offering

(“IPO”) of APMTerminals Bahrain.

The transaction comprised an

offering of 18,000,000 shares

70% of which were allocated to

institutional investors (i.e., those

applying for over 100,000 shares)

while 30% of the shares have been

allocated to retail investors (i.e.,

those applying for up to 100,000

shares). The IPO generated total

demand of 97.4 million shares

or BHD 64.3 million between

both the institutional and retail

t r anches resu lt i ng i n an

oversubscription from funded

applications 5.4 X the offer size.

A total applications for 85.6

million shares, which trans-

lates into BHD 56.5 million, was

received through the institu-

tional tranche, while the retail

tranche received applications for a

total of 11.8 million shares, which

translates into BHD 7.8 million.

Funded applications received

totaled 6.8 X the offer size

pertaining to the institutional

tranche to be allotted on a pro

rata basis. Furthermore, the of-

fer also resulted in an oversub-

scription pertaining to the retail

tranche, having received funded

applications totaling 2.2 X the

offer size. The retail tranche

will be allotted a number of

shares that may be less than the

initial minimum retail allocation

up to (15,000 shares) for retail

applicants of (15,000 shares) or

less (as further detailed in the

IPO prospectus registered with

the CBB on 29 October 2018).

Following the successful public

offering, the ownership structure

of APM Terminals Bahrain is as

follows: APM Terminals BV (64%),

YBA Kanoo Holdings of Bah-

rain (16%), and IPO applicants

(20%). APM Terminals BV is the

company which operates a global

network of 74 operating ports

and terminal facilities and over

117 Inland Services operations

spread over 58 countries, is part

of the A.P Moller – Maersk group,

a global business headquartered

in Copenhagen, Denmark, with

activities in the transport and

l o g i s t i c s wh i c h i n c l ud e s

the biggest container ship

op e r a t o r i n t h e wo r l d .