2

Issue 25 - SEPTEMBER 2020

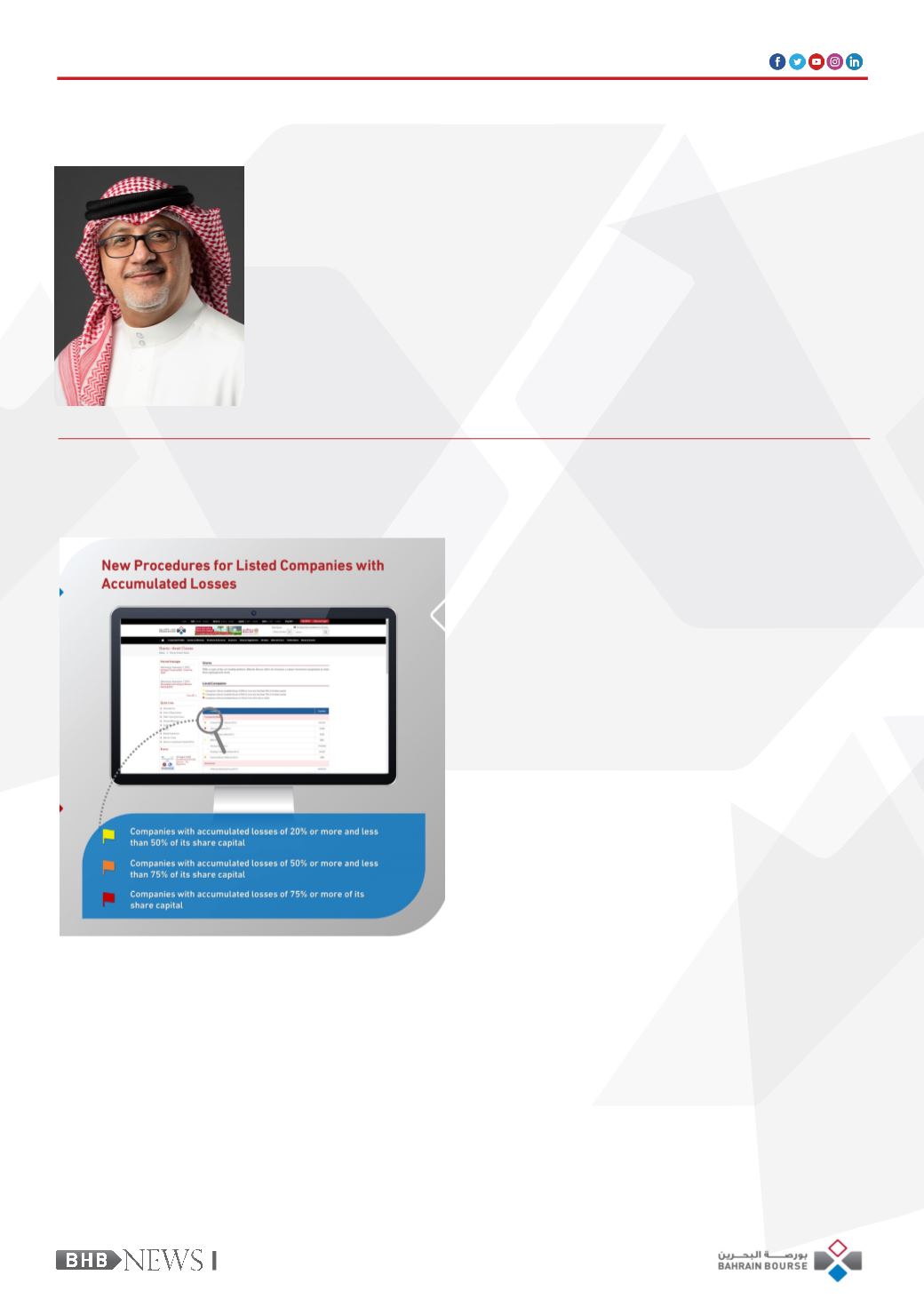

www.bahrainbourse.comBAHRAIN BOURSE ADOPTS NEW PROCEDURES FOR LISTED

COMPANIES WITH ACCUMULATED LOSSES

As part of Bahrain Bourse’s (BHB)

continuous efforts to develop the

Capital Market in the Kingdom of

Bahrain and enhance transparency

in the market, BHB announced the

implementation of new procedures

related to listed companies with

accumulated losses of 20% and

above of its share capital based

on the financial results of the

third quarter 2020, following

obtaining approval from the

Central Bank of Bahrain.

The new procedures, which will

come into effective implementation

as of the third quarter financial

results 2020, and will classify and

color-flag listed companies with

accumulated losses on Bahrain

Bourse’s website under “Products

& Services – Asset Classes”,

enabling investors and others

to clearly identifythe financial

position of listed companies

and make informed investment

decisions. As per the new

procedures, listed companies

with accumulated losses will be

classified into three categories

upon disclosure of its financial

results: the first category will

include companies with losses

between 20% and less than 50%

of their share capital, the second

category will include companies

with losses of 50% up to 75% of

their share capital, and the third

category will encompass companies

with accumulated losses of 75%

and above of its share capital.

Accordingly, listed companies

within the first category will

be yellow-flagged on Bahrain

Bourse’s website, and listed

Companies within the second

category will be orange-flagged,

a nd t h e t h i r d c a t e g o r y

will be red-flagged. Under the new

procedures, listed companies are

required to make an immediate

public disclosure once its

accumulated losses reach 20% or

more of its share capital. Companies

shall disclose the total accumulated

losses, its percentage of the

share capital, justification of the

accumulatd losses, and measures

taken to restore its financial

position. The company will be

flagged accordingly indicating

that it has reached accumulated

losses. After restoring its financial

position, the company shall

immediately disclose to the public

the reduced accumulated losses,

and the yellow flag on the website

will be removed accordingly.

The same procedure shall apply to

the companies with accumulated

losses that reach 50% or more of

its share capital. The company will

be orange-flagged indicating that

it has reached accumulated losses

of 50% or more of its share capital.

In the event that accumulated

losses of a listed company reach

75% or more of its share capital,

BHB will immediately suspend

the trading on the company and

the company will be red-flagged

until a public disclosure is made

once the company’s accumulated

losses are reduced to 75% or below.

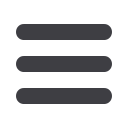

Bahrain Clear announced the

election of its Senior Director of

Operations, Mr. Abdulla Abdin, as

President of the Africa and Middle

East Depositories Association

(AMEDA) following the retirement

of Mr. Mohamed Abdulsalam.

Mr. Khaldoun Al-Tabtabaie, CEO

of Kuwait Clearing Company,

was elected as Vice President

during the Association’s Global

meeting that was held virtually.

AMEDA was established in April

27, 2005. AMEDA is a non-profit

o r g a n i z a t i o n c omp r i s e d

o f C e n t r a l S e c u r i t i e s

Depositories and Clearing

Houses in Africa and the Middle

East. The Africa & Middle East

Depositories Association is formed

for the benefit of its Member

community, as an elective,

inter-professional and regional

facility to foster a spirit of coop-

eration, reciprocity and harmo-

ny among members, to achieve

those objectives it determines

from time to time. AMEDA

includes 30 members comprising

of Central Securities Deposito-

ries and Clearing Houses across

Africa and the Middle East.

BAHRAIN CLEAR REPRESENTATIVE ELECTED AS PRESIDENT

OF AMEDA